[ad_1]

In a time when many consumer-facing fintech startups are grappling with the difficult fundraising panorama, Develop Credit score Inc. has defied the percentages.

The leading edge fintech corporate, based in 2018 with a project to advertise monetary inclusivity, has effectively finished a $10 million Sequence A investment spherical. This success, led by way of USAA, underscores Develop Credit score Inc.’s dedication to its project and its resilience in a aggressive marketplace.

USAA’s funding now not most effective marks an important milestone for the startup but additionally strengthens the strategic partnership between the 2 entities. With the infusion of unpolluted capital, Develop Credit score Inc. targets to make stronger its platform, which facilitates interest-free digital bank card bills for over 100 widespread subscriptions and main mobile phone plans. This building will empower extra folks, together with the ones within the army, veterans, and their households, to construct a brighter monetary long run.

Develop Credit score Inc.’s imaginative and prescient is to decrease the obstacles of access for thousands and thousands of American citizens searching for to determine and construct credit score. Via combining a small-dollar mortgage with a digital MasterCard, the corporate’s leading edge carrier is helping arrange subscription bills whilst reporting mortgage balances to credit score bureaus. This means lets in folks to show enhancements of their compensation historical past to main credit score bureaus by way of leveraging their subscription accounts.

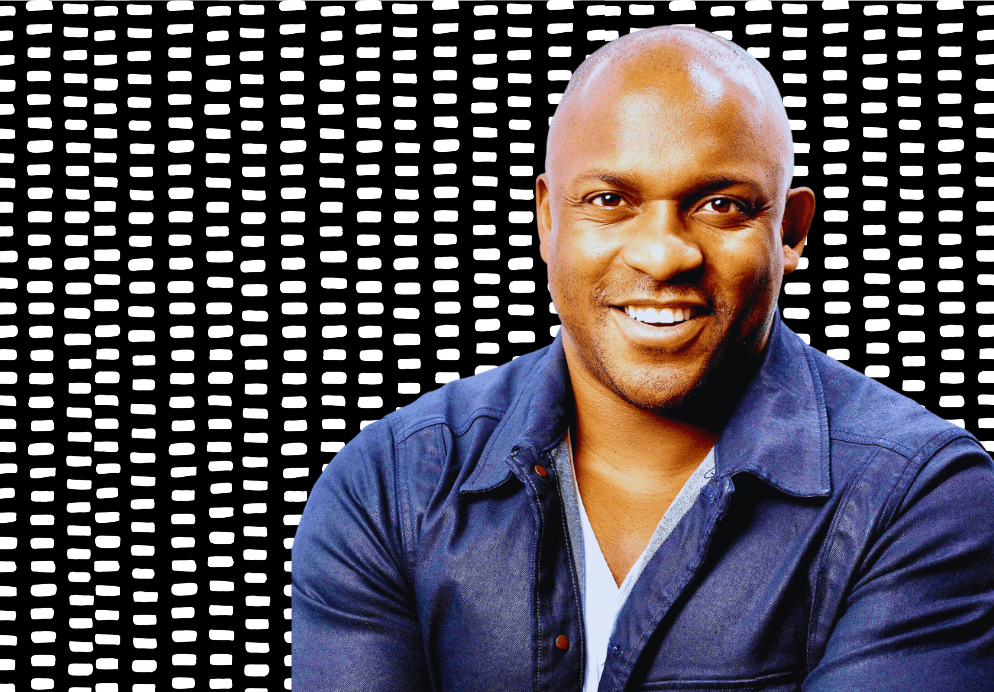

CEO Joe Bayen expressed his enthusiasm in regards to the partnership with USAA, announcing, “We’re commemorated to have one of the crucial monetary services and products business’s maximum mission-driven establishments, USAA, as our lead investor.” He additional emphasised the significance of this partnership in an technology the place many courageous people who have served the rustic are dealing with monetary demanding situations because of pricey credit score.

by way of Tony O. Lawson

Keen on making an investment in Black founders? Please entire this transient shape.

Keen on making an investment in Black founders? Please entire this transient shape.

Market it with us

Market it with us

Similar

[ad_2]