[ad_1]

Dune-bashing in Dubai. Mountain climbing to Machu Picchu in Peru. Marveling on the Taj Mahal in India. Occurring a safari in South Africa.

Whilst it appears like an excerpt from a brochure, those are only a handful of the stories I’ve been ready to test off my private bucket checklist for shuttle.

Hello, my identify is Oneika and in an ordinary yr, I consume, sleep, and breathe shuttle. There’s one thing about being someplace new, seeing one thing other, and studying about other customs, cultures, and traditions that simply… will get me.

However when you’ve adopted me for any period of time, you’ll additionally know that I’ve shifted my center of attention to bucket checklist journeys and stories. I imply, in my thoughts, if I’m getting on a airplane, teach, or automotive I may as smartly move giant earlier than I am going house, amirite?!

Almost, which means I didn’t simply discuss with Victoria Falls, I low-key swam in it (and bungee jumped off the Victoria Falls Bridge, however that’s a tale for any other day). I’ve additionally slept in a yurt within the Mongolian steppe, ziplined via Costa Rican rainforest, and performed top tea too again and again to depend in London.

Then again, whilst those bucket checklist adventures are epic, exciting, and enjoyable, the cruel fact is that this: they may be able to be relatively pricey.

One of the most primary causes other folks don’t shuttle is as a result of they suspect they may be able to’t have the funds for it. However as any individual who has devoted my platform to creating exploration and discovery extra obtainable, I’ve discovered that there are a couple of simple issues you’ll be able to do to return nearer to creating your shuttle desires a fact.

That’s why I’m excited to spouse with You Want A Finances to percentage 3 primary pointers and tips for tips on how to funds in your journeys, whether or not they’re giant or small!

___

Making shuttle a concern

One of the most questions I’m requested essentially the most regularly through pals, circle of relatives, and strangers is how I will have the funds for to shuttle such a lot. Right here’s my giant “secret”: whilst I’m no longer wealthy, I have a tendency to allocate the cash I do need to journeys and stories. Which means as a substitute of spending cash on the newest smartphone or a clothier handbag, I put it aside for bucket checklist adventures in a foreign country… like going to Egypt to peer the pyramids of Giza.

I’m additionally ready to save lots of more cash on account of positive way of life alternatives I’ve made, like no longer having a automobile (gasoline and insurance coverage are pricey). As a result of my interest for discovery is of the maximum significance, I’m prepared to make little “sacrifices” like no longer getting cable (I most commonly move on Netflix anyway) or skipping appetizers and dessert once I move out to consume in order that I’ve more cash to place against my dream journeys. This can be a easy, but efficient technique!

Cautious making plans

I will’t tension the significance of meticulous making plans on the subject of reserving my bucket checklist travels! On every occasion conceivable, I attempt to shuttle to a vacation spot all over its off-peak season so I will no longer most effective keep away from the crowds but in addition profit from discounted air fares, sights, and lodging. Talking of lodging, I frequently examine the value of staying in an Airbnb/ holiday condominium vs. a resort room and move with the less expensive possibility. Relying on my vacation spot and what sort of money and time I’ve to burn, staying in a single as a substitute of the opposite may simply make extra sense (and lend a hand me save extra greenbacks and cents, haha).

Some other technique that has allowed me to shuttle extra regularly and at a less expensive charge has been to chase the deal and no longer the vacation spot. I have a tendency to devise my travels at the present time in accordance with the most cost effective airfares and shuttle reductions at a given time, and no longer simply in accordance with the place I need to move/what I need to enjoy.

Creating a correct funds and sticking to it

Whilst prioritizing and making plans play a elementary function in my skill to tick pieces off my shuttle bucket checklist, the 3rd, and for my part maximum vital, component on this equation is budgeting.

I’ll be fair, I’ve at all times been lovely excellent with managing my cash alone. However since I began the use of You Desire a Finances to consciously plan for the longer term, I’ve a extra correct image of my budget and higher keep watch over over when, how, and why I spend my cash.

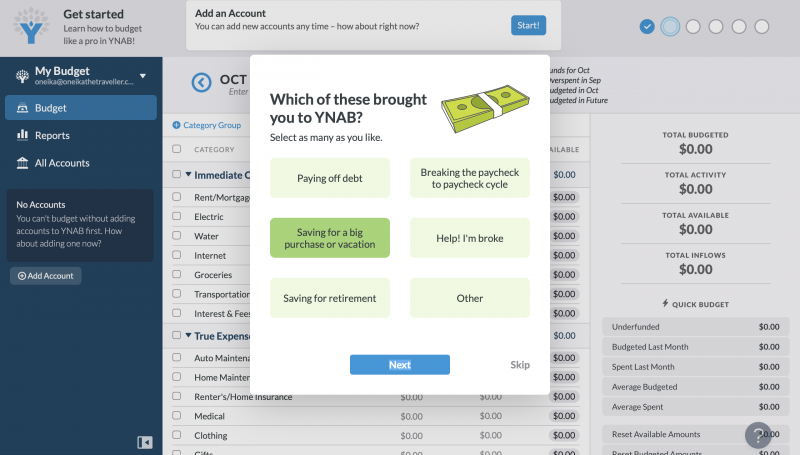

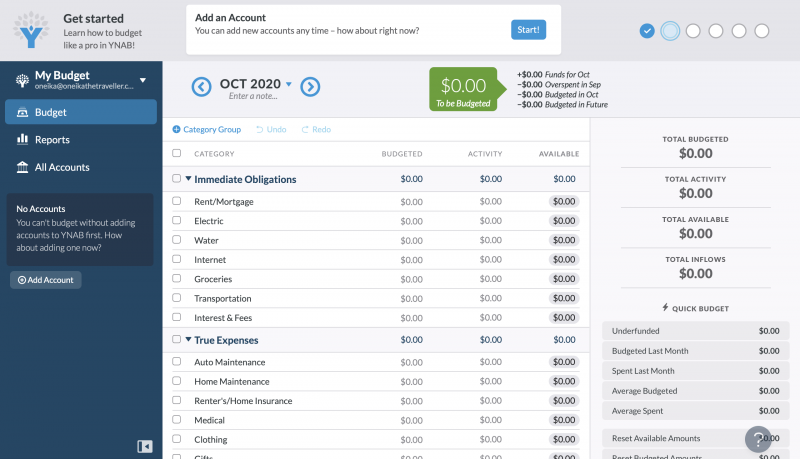

However simply what is that this magical You Desire a Finances, you ask? Smartly, You Desire a Finances (YNAB for brief) is an award-winning private finance tool that can educate you tips on how to get out of debt, prevent dwelling paycheck-to-paycheck, and save more cash as a way to spend it at the issues that subject maximum to you (touring, in my case).

In my view, You Desire a Finances has helped me to create a spending plan so I will prioritize and plan for long term shuttle or primary lifestyles occasions. Signing up is terribly simple! For the reason that interface is so easy and transparent, inside of 10 mins I used to be ready to enter all my account main points and bills so as to get started a financial savings plan.

Now not too positive you’re in a position to dedicate? YNAB no longer most effective has a unfastened 34-day trial that doesn’t require you to provide your bank card main points, it additionally gives instructional content material, vidoes, and reside workshops each and every unmarried day which are utterly FREE.

You’ll be able to check out YNAB for 34-days unfastened (no bank card required) when you click on right here!

The item I love maximum about YNAB is that it takes the strain and thriller out of budgeting. YNAB’s 4 Laws set you up for luck through treating the funds as a day-to-day way of life software, quite than some loopy aspirational plan that you’ll be able to’t take care of. Their 4 Laws are:

○ Give Each and every Greenback a Activity. Know precisely how you need to spend the cash you might have to be had – and most effective the cash you might have at this time – earlier than you spend a dime. This is helping make sure that you might have cash for the issues that subject maximum to you!

○ Include Your True Bills. Determine what you in reality spend and deal with the ones rare bills (like the vacations, twice-a-year automobile insurance coverage or changing your computer each and every two years) like per month bills for your per month funds. Breaking giant or unusual bills down approach you received’t be shocked through them.

○ Roll With the Punches. Settle for that issues alternate and your funds must be versatile (particularly in a yr like this one, whew!) You received’t spend an identical quantity on all classes each and every month, so be ready to transport cash round. Transferring cash round doesn’t imply you’re budgeting improper, it approach you’re in truth budgeting!

○ Age Your Cash. Destroy the paycheck-to-paycheck cycle through running against the use of the cash you earned closing month to pay this month’s bills. This margin will create extra peace of thoughts than you’ll be able to even believe.

Supply: YNAB

Creating a correct funds doesn’t need to be a large deal or a horrifying prospect you probably have the suitable gear. The usage of YNAB has allowed me to take whole keep watch over of my budget so I will have the funds for to spend at the issues I in point of fact price, like bucket checklist shuttle! This can be a giant step at the street to monetary freedom.

___

So there you might have it, my 3 pointers for the way I have the funds for to shuttle so widely and funds for my bucket checklist adventures! In essence it boils all the way down to this: severe prioritizing, diligent making plans, and EXCELLENT budgeting. What pointers do you might have for the way you have the funds for to shuttle? Drop ‘em within the feedback underneath!

This submit was once written in partnership with You Desire a Finances however all evaluations are my very own.

[ad_2]