[ad_1]

You will need to determine industry credits once making a decision to enter industry. Having excellent industry credits is at all times essential, and also you additionally want to know how below-average credit can impact your corporation. Essentially the most impactful side of industrial credits is your talent to protected financing. In case you have below-average credit, you received’t be capable of qualify for loans, bank cards, and different varieties of financing. This can also be catastrophic for a brand new industry. Whilst you perceive your ranking and take care of it at a top degree, you’re for your approach to working a a success industry.

You will need to determine industry credits once making a decision to enter industry. Having excellent industry credits is at all times essential, and also you additionally want to know how below-average credit can impact your corporation. Essentially the most impactful side of industrial credits is your talent to protected financing. In case you have below-average credit, you received’t be capable of qualify for loans, bank cards, and different varieties of financing. This can also be catastrophic for a brand new industry. Whilst you perceive your ranking and take care of it at a top degree, you’re for your approach to working a a success industry.

Construction industry credits doesn’t occur in a single day. You should be certain your corporation is registered with the right kind credits businesses, create industry accounts that report back to industry credits bureaus, and pay your expenses on time. Construction sturdy industry credits can get advantages what you are promoting in some ways. With a top industry credits ranking, getting industry financing, securing industry insurance coverage, or setting up cost phrases with providers can also be more economical. It could possibly even lend a hand your corporation land company contracts, as steadily firms require evidence of economic balance and on-time bills prior to awarding an important contract. Since there’s no notification when your corporation credits is reviewed, it’s possible you’ll by no means understand how your credits historical past has affected your corporation.

You’ll be able to determine industry credits with any industry construction, together with LLCs and S-corporations. You might be able to determine industry credits as a sole owner with a registered industry title. Then again, remember the fact that with out a registered felony entity, you’ll by no means in reality be capable of separate your corporation and private credits. Additionally remember that non-public bank cards are simplest reported to shopper credits bureaus, no longer industry credits bureaus. Subsequently, paying your individual expenses on time, whilst a excellent observe, won’t let you determine industry credits. Even though you utilize your individual bank cards to pay for industry bills, it’s going to no longer let you construct a industry credits portfolio.

Does Your Private Credit score Subject for Your Industry?

Sure, a small industry proprietor’s non-public and industry credits are each essential. It is not uncommon for shops or lenders to require non-public credits tests for small industry bank cards or loans. So, conserving your individual credits ranking top is a good suggestion. The great factor is that you’ll be able to get started development industry credits even though your individual credits isn’t the best. The important thing to development a excellent industry credits ranking is to do industry with corporations that record cost historical past. Then pay on time and stay your debt ranges beneath regulate.

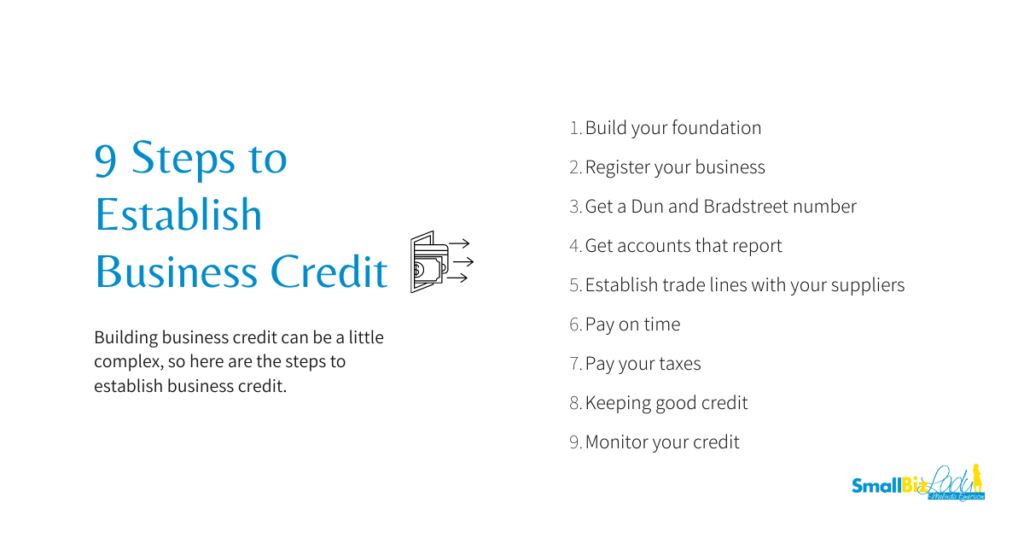

9 Steps to Identify Industry Credit score

Construction industry credits is usually a little complicated, so listed below are the stairs to ascertain industry credits.

- Construct your basis

- Sign in your corporation

- Get a Dun and Bradstreet quantity

- Get accounts that record

- Identify business traces along with your providers

- Pay on time

- Pay your taxes

- Protecting excellent credits

- Track your credits

1. Construct Your Basis

To successfully determine industry credits, it is helping to ascertain your corporation correctly. If your corporation is new, make an effort to arrange your corporation, so apparently skilled. Get a industry telephone quantity and, if imaginable, get it indexed in listing help. Get and use a certified e mail cope with. Make a selection and constantly use a industry cope with, which is usually a PO Field and even your own home cope with in the event you’re simply beginning.

2. Sign in Your Industry

Maximum companies will have to be formally registered with their state. You’ll have finished this step in the event you shaped a industry entity similar to an LLC or S Corp on your state. Annual filings might be required. (In the event you began your corporation in every other state, you may additionally want to sign in your corporation within the state the place you do industry.) You may additionally want to get skilled or industry licenses. Take a look at your state necessities. Some industrial credits businesses would possibly use public knowledge similar to this to start out your corporation credits profile.

3. Get a D-U-N-S Quantity

A DUNS quantity is your corporation identifier with the credits reporting company Dun & Bradstreet. If your corporation doesn’t have already got one, you will have to request one, and it’s loose. Creditsafe, Equifax, and Experian all have separate identifiers (numbers to spot your corporation of their techniques), however you don’t need to start up this request with them. An EIN is the industry ID quantity each and every industry must get from the IRS. Having one isn’t required to ascertain industry credits. Then again, you’ll be able to’t open a industry checking account with out an EIN.

4. Identify Accounts That Record

To begin development your credits, you wish to have to ascertain accounts that can report back to industry credits bureaus. Preferably, you’ll need to grasp a minimum of two to 3 credits accounts with corporations that record. They may be able to be supplier accounts with an workplace provide retailer, a industry bank card, or a credit-builder account. Extra accounts can also be useful as your corporation grows. Relating to your corporation credits ranking, maximum small industry lenders like to look a industry credits ranking above 75. Nonetheless, native lenders similar to CDFIs or Group Building Monetary Establishments would possibly imagine decrease rankings for small companies or startups. Standard shopper financing corporations hardly make loans to folks with credits rankings under 600.

3 of probably the most reasonably priced reporting accounts are:

Summa Administrative center Provides

Strategic Community Answers

Ohana Administrative center Merchandise

The advantage of doing that is to have your cost historical past reported to the credits bureaus and determine your corporation credits; if in case you have established industry credits, those 3 reviews will make stronger what you might have constructed up. Those corporations ship knowledge to the credits bureaus at the closing industry day of each and every month.

5. Identify Industry Traces with Your Providers

Providers steadily lengthen business credits, which lets you pay a number of days or even weeks after you obtain the stock. This accounts-payable dating can spice up your corporation credits ranking, supplied your provider reviews bills to a industry credits bureau. You’ll be able to arrange business traces with any small supplier, similar to your water provider, payroll corporate, or wholesale distributor. If the ones distributors don’t report back to a credits bureau, you’ll be able to record them as a business reference for your account, and Dun & Bradstreet will practice as much as acquire your business knowledge.

6. Pay on Time

Cost historical past is the one maximum essential issue for development industry credits. You should stay accounts present and lively over a time period to display the expansion and creditworthiness of the industry. Pay on time or early if you’ll be able to, and you will construct your corporation credits ranking extra temporarily.

7. Pay Your Taxes

Unpaid taxes or industry debt may end up in a lien, granting collectors a felony proper to snatch your private home to meet the debt. And remarkable debt would possibly in the end lead to a courtroom ruling — or judgment — in opposition to your corporation to gather the debt. Those adverse marks on your corporation credits record can hang-out you. Bankruptcies, for instance, keep for your Experian credits ranking for 10 years; tax liens, judgments, and collections stay for nearly seven years.

8. Stay Your Credit score

One of the essential steps in development industry credits is keeping up it while you achieve the extent you need. Paying expenses on time or early and setting up excellent relationships along with your providers, collectors and lenders are the very best techniques to take care of your corporation credits ranking. Then again, it’s essential to take into account that a part of development excellent industry credits is creating sturdy monetary behavior: saving cash, paying expenses well timed, and making knowledgeable monetary selections about the way forward for your corporation. Growing those behavior feeds into the holistic monetary enjoy your corporation must have to ascertain agree with and construct a a success observe document.

9. Track Your Credit score

Tracking your corporation credits historical past can provide you with a warning to issues so you’ll be able to examine additional. Take a look at your credits reviews and rankings with multiple main credits reporting company to determine whether or not your accounts are serving to your rankings. If no longer, imagine including further credits references. In the event you to find an error, record a dispute with the credits bureau reporting the error.

New accounts would possibly not seem on your corporation credits reviews for a couple of months. When they do, you’ll want a number of months of on-time bills to ascertain industry credits and get a excellent credits ranking. Whether or not you might have a brand new industry or one this is well-established, if you are taking the stairs above, you might be able to determine industry credits in six months to a 12 months. The great factor is that you’ll be able to spend as low as $100 a month to construct your corporation credits.

[ad_2]